what is ach credit tax products

In the Payment method dropdown select the payment method. Dealers are required to file a 1099-B form when a customer sells the minimum quantity of any Precious Metals product that is included on the IRSs Reportable Items List.

Amazon Com Old Version Turbotax Deluxe 2020 Desktop Tax Software Federal And State Returns Federal E File Amazon Exclusive Mac Download Everything Else

Select Enter credit card details and enter the card info.

. Fill out the form. Select Process credit card and then Save. Add the products and services youre selling.

If you have additional questions please consult a tax professional for details on your specific tax situation. When is a 1099-B filed. Or if you have a Magtek card reader select Swipe Card and swipe their card.

Tax Prep Fee Payment Options With Taxwise Wolters Kluwer

3 17 277 Electronic Payments Internal Revenue Service

Tpg Check And Refund Disbursement Details

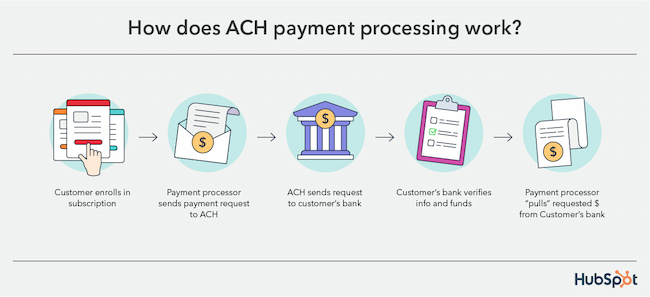

Ach Payment What It Is How It Works How Much It Costs

Employer Withholding Department Of Taxation

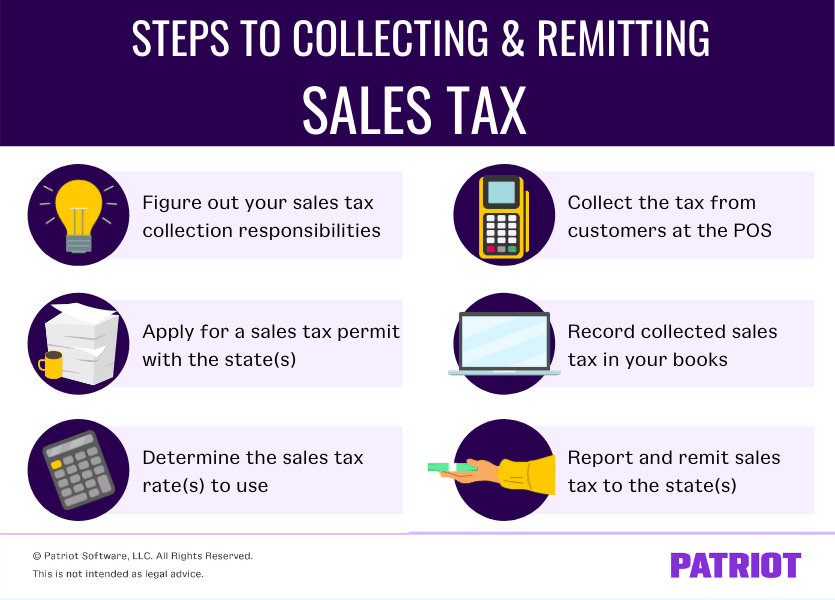

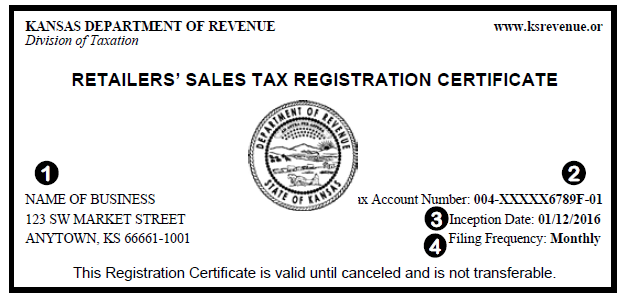

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Onlinemetals Com Buy Metal And Plastics At Online Metals Onlinemetals Com

How To Set Up Sales Tax In Quickbooks Online Youtube

Ach Payment What It Is How It Works How Much It Costs

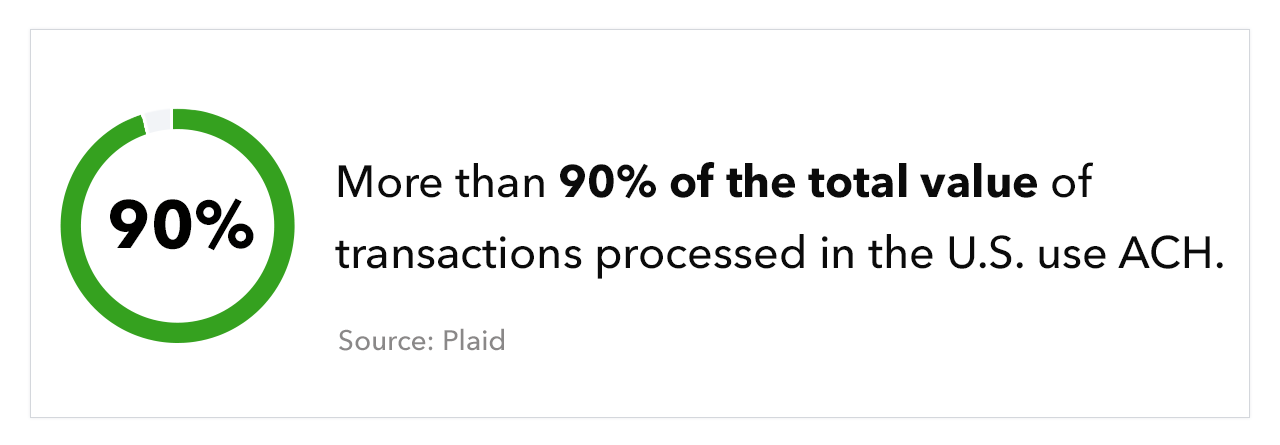

What Is Ach Credit And How Does It Work Plaid

The Tax Plug Another Happy Client Approved For A 3k Facebook

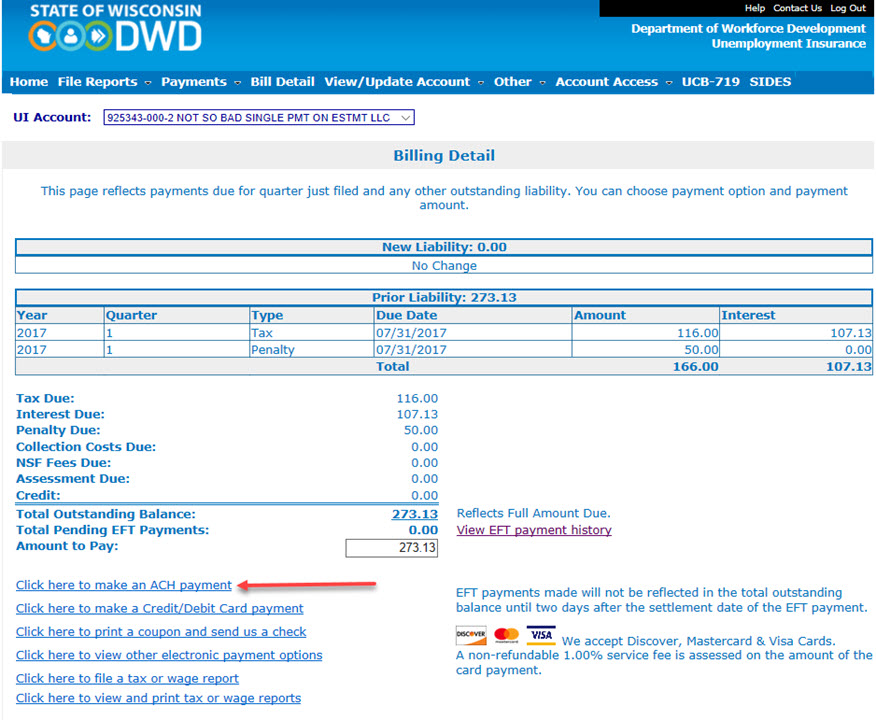

Automated Clearing House Ach Debit Payment Option For Employers Wisconsin Unemployment Insurance

3 17 277 Electronic Payments Internal Revenue Service